Understanding Stock Prop Firms: A Comprehensive Guide to Financial Success

In today's ever-evolving financial landscape, the role of stock prop firms has become increasingly significant. Prop trading firms, or proprietary trading firms, offer traders and investors a unique opportunity to engage in the markets using the firm’s capital. This article will explore the intricacies of stock prop firms, their benefits, and how they work within the broader context of financial services and financial advising.

What Are Stock Prop Firms?

Stock prop firms are specialized trading companies that use their own capital to trade financial instruments like stocks, options, and futures. Unlike traditional investment firms that manage client funds for a fee, prop firms allow traders to operate using the company's funds, thus amplifying their potential profits (as well as the associated risks).

These firms typically provide a unique setup where traders can gain experience, leverage financial resources, access technology, and benefit from expert mentorship. Ultimately, this structure enables traders to enhance their skills and profitability without risking their financial capital.

How Do Stock Prop Firms Operate?

The operational model of stock prop firms can vary, but several core components remain consistent:

- Trader Training: Many prop firms offer extensive training programs designed to develop traders' skills. New recruits often undergo simulations, mentorship, and educational courses on trading strategies.

- Capital Allocation: Successful traders receive a certain amount of the firm’s capital to start trading. This significantly lowers their financial burden while allowing them to operate at higher stakes.

- Profit Sharing: Most prop firms operate under a profit-sharing model, where traders receive a percentage of their profits (typically ranging from 50% to 80%). This incentivizes traders to maximize their performance.

- Resource Access: Traders have access to state-of-the-art trading platforms, analytical tools, and financial research resources, all of which can enhance their trading strategies.

The Benefits of Joining Stock Prop Firms

There are numerous advantages associated with joining stock prop firms:

- Reduced Financial Risk: By trading with the firm's capital, you minimize your own financial risk, allowing you to experiment and hone your trading strategies over time.

- Skill Development: Continuous training and mentorship from experienced traders can significantly enhance your trading prowess.

- Access to Capital: Prop firms typically provide ample funding to serious traders, enabling you to take larger positions and increase potential profitability.

- Networking Opportunities: Being part of a prop firm allows you to connect with other traders, share insights, and foster relationships that may enhance your financial career.

- Flexible Trading Styles: Many firms permit traders to pursue various trading styles, from day trading to swing trading, depending on their expertise and interests.

The Role of Technology in Stock Prop Firms

In today’s fast-paced market environment, technology plays a crucial role in the operations of stock prop firms. Here are key aspects of how technology impacts trading:

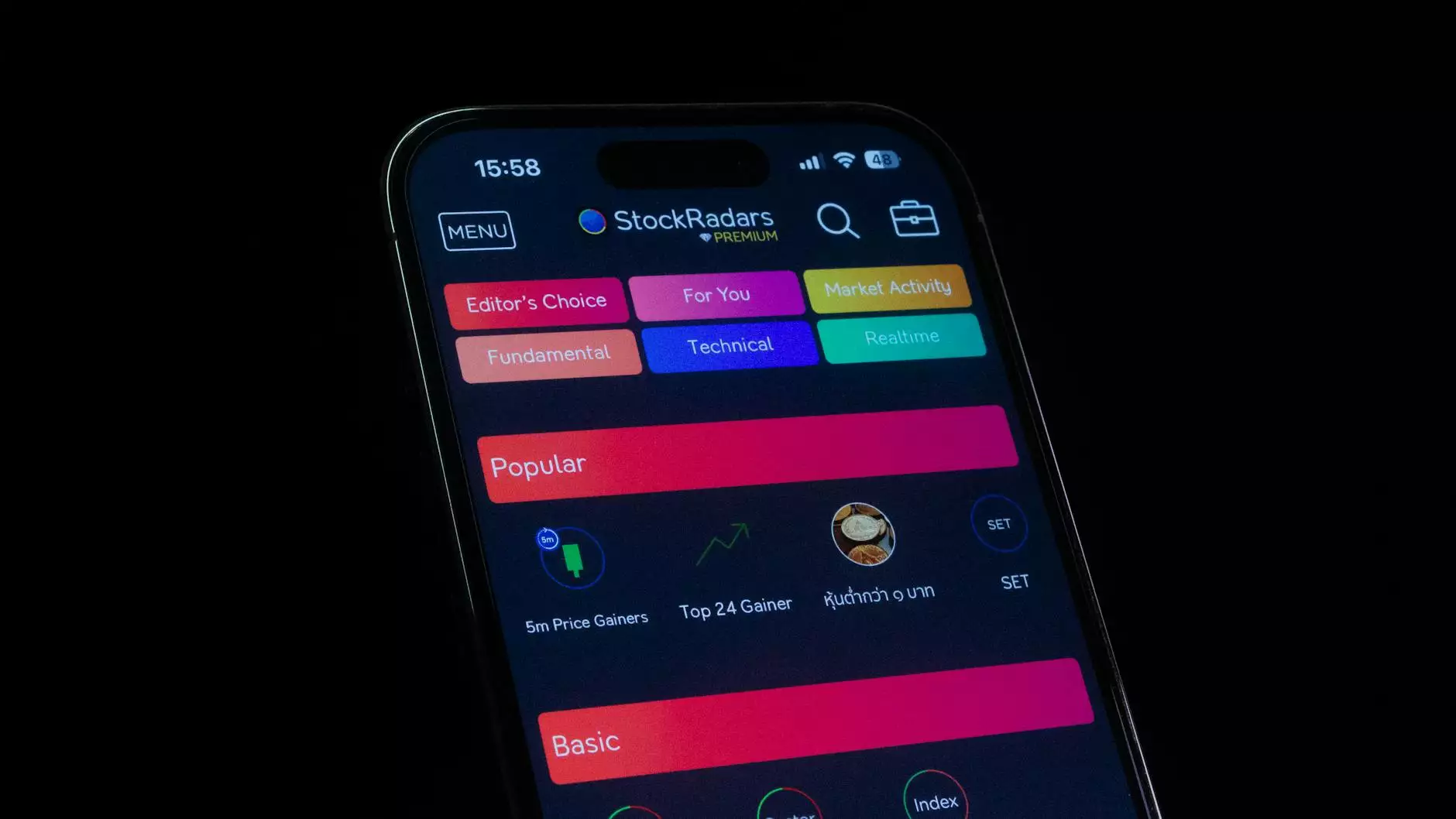

Advanced Trading Platforms

Most prop firms provide access to advanced trading platforms equipped with sophisticated analytics tools, high-speed execution capabilities, and a variety of financial instruments. This tech-forward environment empowers traders to make informed decisions quickly.

Algorithmic Trading

Many prop firms utilize algorithmic trading strategies to maximize returns. By employing algorithms that analyze market data, traders can capitalize on fleeting opportunities faster than human capabilities would allow.

Real-Time Data Feed

Access to real-time market data is critical for success in trading. Prop firms typically offer comprehensive datasets that inform traders on price action, trading volumes, and market sentiment, enabling them to execute trades effectively.

Choosing the Right Stock Prop Firm

With various options available in the realm of stock prop firms, selecting the right one can greatly influence your trading success. Here are essential factors to consider:

- Reputation: Research the firm's track record, testimonials, and community feedback to ensure a reliable and reputable partnership.

- Training Programs: Evaluate the quality of training and educational support provided. A great firm will invest in your development.

- Profit Split: Understand the profit-sharing model. Ensure the terms are favorable and motivate trading performance.

- Trading Tools: Assess the tools and technologies available. A good prop firm should equip you with what you need to succeed.

- Culture and Community: The firm's culture should align with your values. A collaborative and supportive environment can significantly impact your experience.

Risks Involved in Trading with Stock Prop Firms

While the benefits are significant, trading at stock prop firms also comes with risks. Recognizing these risks can help you navigate the trading landscape more effectively:

- Inherent Financial Risks: Despite trading with firm capital, the necessity to meet performance benchmarks can impose financial pressure.

- Loss of Personal Capital: Depending on the firm, traders might be required to contribute a portion of their personal capital, which remains at risk.

- Job Security: Many prop firms operate on a "performance-based" model. Traders who do not meet certain profitability targets may find their positions at risk of termination.

Conclusion: The Future of Stock Prop Firms

In conclusion, stock prop firms represent a potent avenue for aspiring traders to build their careers in the financial services landscape. With advantages such as capital access, risk management, and advanced training, these firms create unparalleled opportunities for success. However, it’s essential to approach this landscape with caution, being aware of the associated risks while actively seeking the right prop firm that aligns with your professional goals.

As the financial markets continue to evolve, staying informed and adaptable will be key to navigating the prop trading environment successfully. Explore your options, enhance your skills, and maximize your potential in this vibrant sector of the financial world.